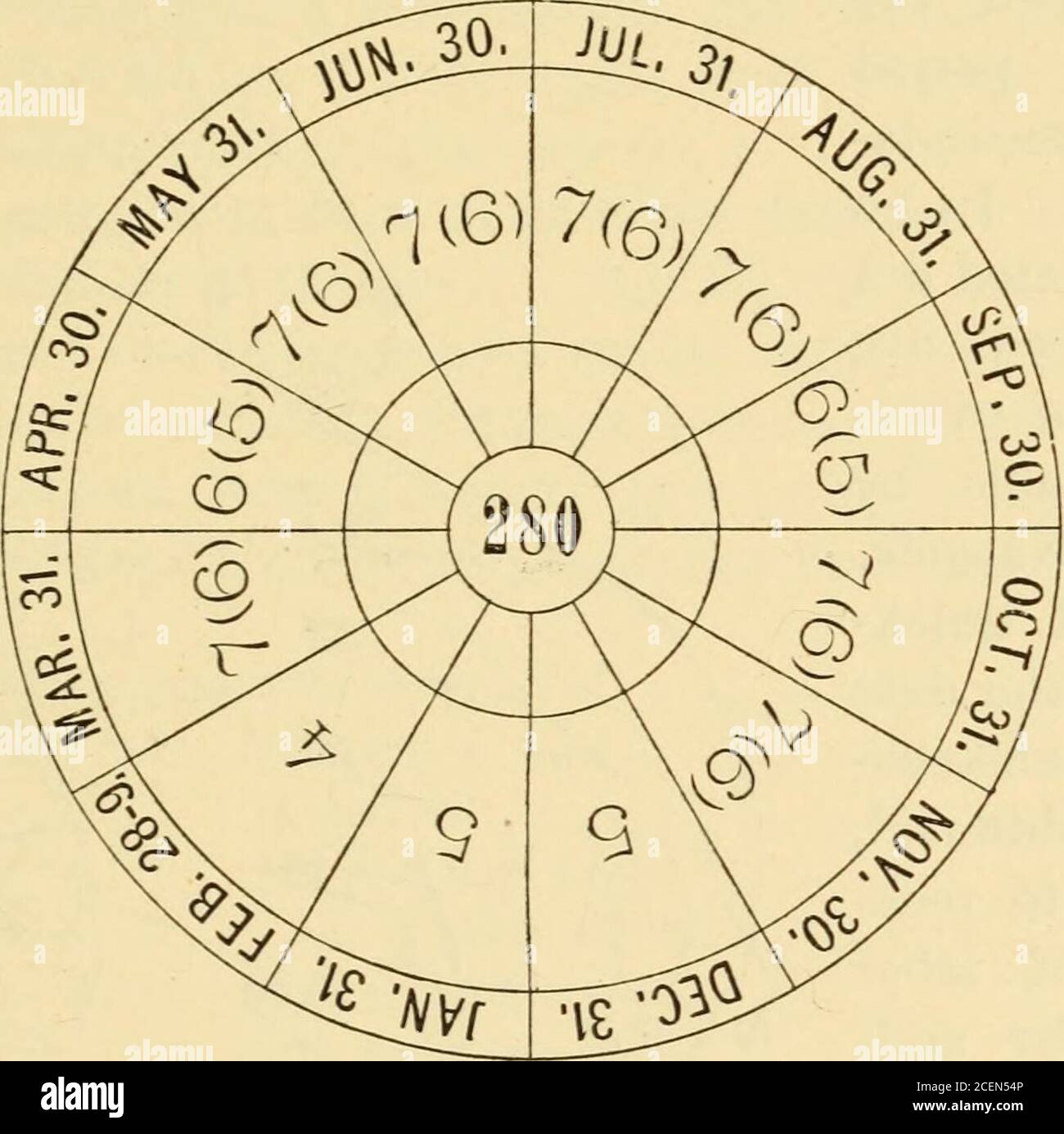

The science and art of midwifery. given date, which has since his time been generallyadopted. This consisted in counting forward nine months, or, whatamounted to the same thing, counting backward three

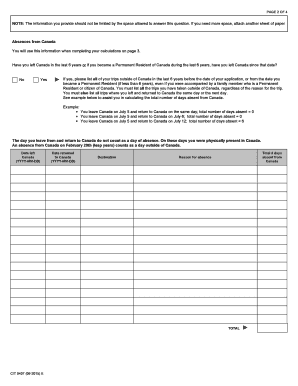

Fillable Online CIT 0407 E : How to Calculate Physical Presence - Immigroup Fax Email Print - pdfFiller

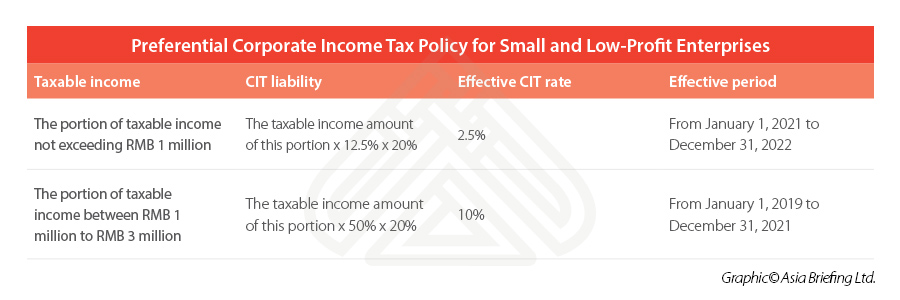

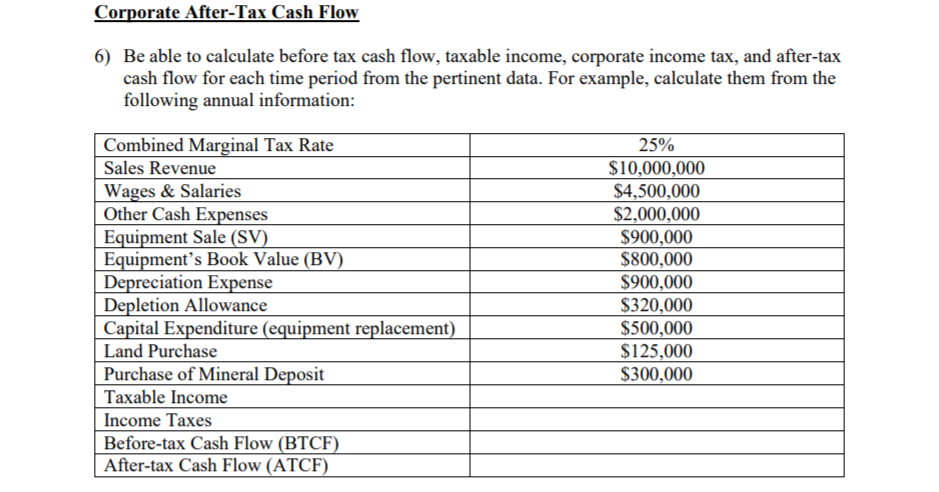

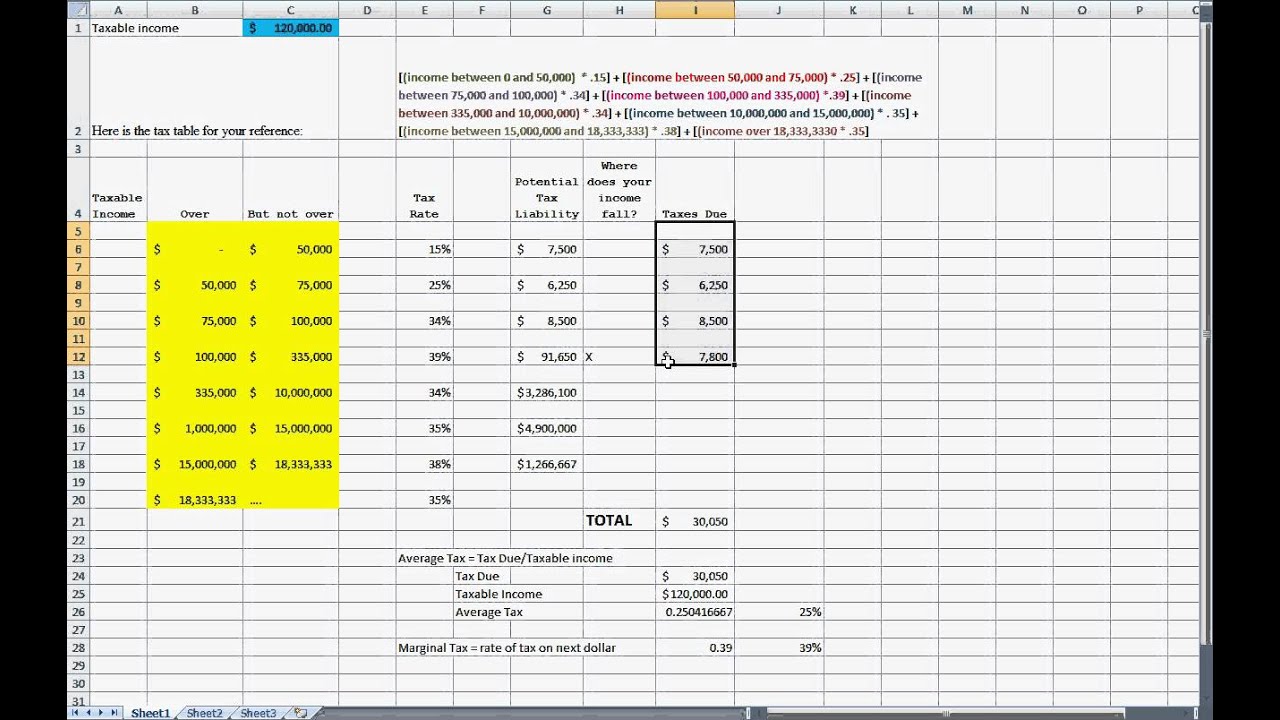

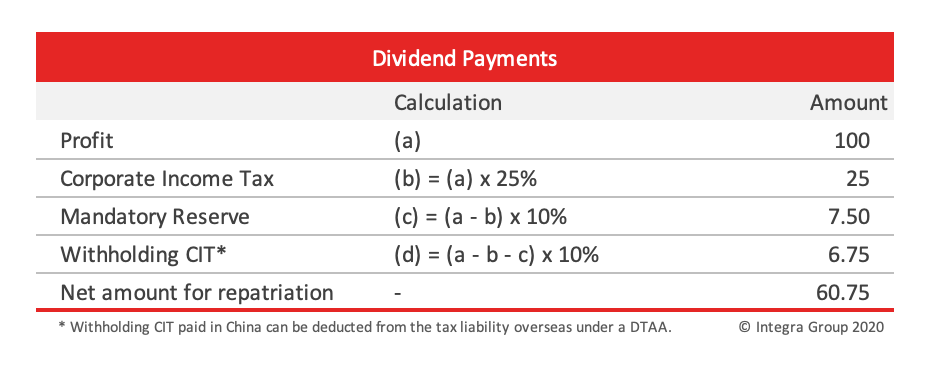

Estimating the Corporate Income Tax Gap in: Technical Notes and Manuals Volume 2018 Issue 002 (2018)

REVENUE ESTIMATING CONFERENCE Tax: Corporate Income Tax Issue: Piggyback Bill/Shift Tax Cut Calculation/Decouple: GILTI (Retro

Calculation of radial and vertical forces on the CIT 1. 75 m vacuum vessel for several TSC disruption scenarios - UNT Digital Library